These federally insured time deposits have specific maturity dates that may range from a number of weeks to a number of years. Because these are “time deposits,” you can not withdraw the money for a specified period of time without penalty. At Bankrate we try that can assist you make smarter monetary decisions https://www.beaxy.com/. While we adhere to strict editorial integrity, this publish might contain references to merchandise from our companions. Financial economics often entails the creation of subtle models to test the variables affecting a particular decision.

Financing breaks down massive purchases into manageable funds that more individuals can afford, which widens the pool of potential clients out there to your corporation. Both consumers and companies profit from financing programs, as a result of financing provides prospects extra shopping for energy and flexibility, and it helps businesses increase gross sales and improve cash circulate.

Last, let’s discuss what sorts of things are NOT investments. Things that lose value over time from you proudly owning them aren’t thought-about investments. It’s essential that you live within your means when it comes to this stuff. There are many differenttypes of investments you could put your money in.

Often, these fashions assume that individuals or establishments making decisions act rationally, though this is not necessarily the case. Irrational conduct of events must be taken into consideration in financial economics as a potential risk issue. It employs financial principle to judge how time, threat (uncertainty), alternative costs, and data can create incentives or disincentives for a specific choice.

What is the goal of financial management?

Financial economics is a branch of economics that analyzes the use and distribution of resources in markets in which decisions are made under uncertainty. Financial decisions must often take into account future events, whether those be related to individual stocks, portfolios or the market as a whole.

The corporations try to maximise earnings or maximise the present value. Due to the operation of the regulation of diminishing returns, marginal product of capital declines as more https://1investing.in/ items of capital are used for manufacturing, the other components being held constant.

Logically, these stocks belong to tech companies manufacturing various kinds of devices, gadgets, computer systems, tools, etc. Some of those corporations, like Microsoft, are also blue-chips inventory. There are many examples in virtually every sector, and as already talked about these are probably the greatest performers. In the USA, these companies are listed on the Dow Jones Industrial Average index.

What Are Financial Goals?

After Keynes, a neoclassical principle of investment has been developed to elucidate funding behaviour with regard to fixed enterprise funding. Short interest principle means that a high level of brief interest indicates an imminent rise in the value of a inventory.

What do you mean by financial economics?

Short interest theory posits that a high number of outstanding short positions on a stock predicts that a rise in the stock’s price is likely to occur in the near future.

Odd Lot Trades

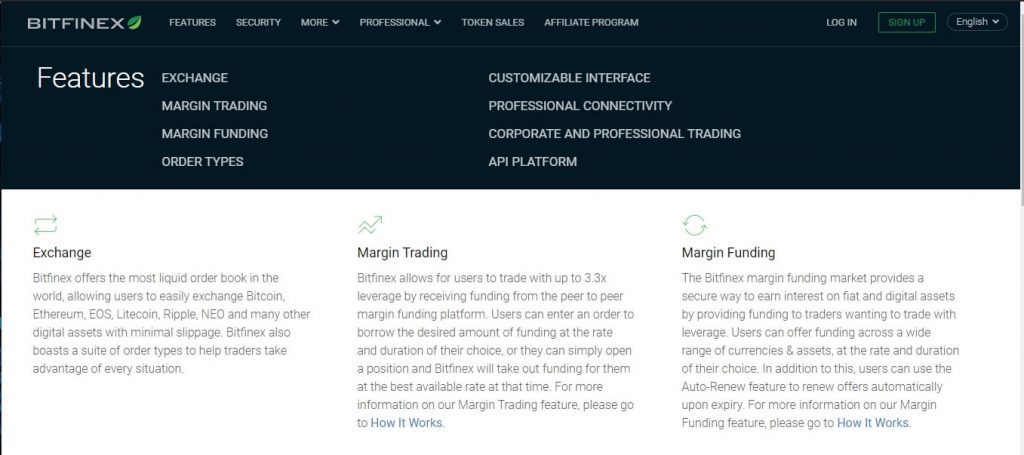

Financial economics is a department of economics that analyzes the use and distribution of assets in markets in which decisions are made beneath uncertainty. Financial selections should typically take into account future events, whether these be related to individualstocks,portfoliosor the market as a whole. Your financing program can encourage customers to return to your small business for future purchases, building model loyalty and serving to you enhance your revenue. When companies supply financing packages, they develop their potential customer base by making their services and products inexpensive for more customers. Not everybody has the money available to fund a large purchase up entrance, like furniture or house renovations.

- Usually, these are firms providing merchandise similar to vehicles, houses, gear – issues that individuals buy when instances are bountiful and reduce on in periods of economic recession.

- All which means their shares’ price can not develop considerably as a result of it’s already excessive sufficient.

- These are stocks of huge, financially stable companies that are often one of the leaders in the respective trade.

- They have been on the market for a very long time and their market cap is estimated to be billions.

- In the stock market, most stocks commerce in lots measurement of one hundred shares, though some greater priced stocks could commerce in a lot of 10 shares.

- This is an equity inventory and it is dependent upon the enterprise cycles – ups and downs of a company as a result of an financial crisis or boom.

An S&P 500 index fund is a superb alternative for starting investors, as a result of it supplies broad, diversified publicity to the inventory market. The U.S. authorities points numerous types of securities to lift cash to pay for projects and pay its money owed. These are a number of the safest investments to guarantee towards loss of your principal. With a CD, the financial establishment pays you interest at regular intervals.

Therefore, no one can have a bonus in the market in predicting prices since there isn’t a knowledge that would offer any extra worth to the investors. In the 1970s Eugene Fama defined an environment friendly monetary market as „one during which prices all the time absolutely replicate obtainable information”.

What are the 6 principles of finance?

Yes, Finance is a good major for undergraduate study. Here are some of the benefits of taking Finance as major. Finance is more guaranteed than other fields. It’s a field with great earning potential and rewarding career options in a wide range of industries.

Once it matures, you get your authentic principal back plus any accrued interest. You might be https://cex.io/ able to earn as much as around 1.8 percent APY on these kind of investments, as of May 2020.

The neoclassical concept doesn’t counsel any totally different monetary policy than that visualized in Keynesian and monetarist macroeconomic theories. Now you will need to explain that the neoclassical principle of investment suggests what types of fiscal and monetary policies can promote funding. Corporation tax is generally believed as a proportion, say, of the income of the businesses.

If you take a look at the expansion graph of an organization, you’ll never find one which rises straight or is with none bends. The development of the cycle of business organization is a combination https://1investing.in/financial-theory/ and merge of highs and lows which in fact might be as a result of varied reasons. Recession, depression, boom or failure, all add as much as the fall of a business.

The larger the company earnings tax the upper the rental price of capital. The tax system of assorted international locations also provides for investment tax credit to promote funding and growth. Under investment tax credit score scheme, the firms are allowed a sure rebate, say, 10 per cent of their funding expenditure, on the tax payable. Besides actual Financial theory rate of curiosity and depreciation, taxes levied by the federal government additionally have an effect on rental value of capital. The corporation tax which is the tax on earnings of the public restricted corporations and investment tax break or development rebate are the two essential tax components which affect the rental value of capital.

As the equation above reveals that desired capital inventory depends on the level of output, and in case of the economy as an entire, on the level of national earnings (GDP). When the level of output or national income is anticipated to extend the whole curve of marginal product of capital (MPK) will shift to the best as shown in Fig. With this increase in the https://www.binance.com/ degree of national product from Y0 to Y1, on the given rental price of capital r0, the specified capital stock increases from K0 to K1. Let r is the price or person cost of capital and p is the value of output. To maximise profits, a firm will equate the marginal product of capital to the real rental price (i.e. consumer price) of capital (r/P).

Municipal bond funds are nice for starting traders as a result of they provide diversified exposure without the investor having to analyze particular person bonds. But when you maintain your assets over time, steadily pay down debt, and grow Financial theory your rents, you’ll have a powerful cash flow when it comes time to retire. Buying particular person stocks, whether they pay dividends or not, is healthier-suited for intermediate and superior traders.

Because of their high market worth, their progress rate is limited, due to this fact buyers primarily revenue from dividends. Therefore, identifying trends or patterns of value adjustments in a market cannot be used to predict the long run value of economic instruments. Fama also created the efficient-market speculation (EMH), which states that in any given time, the prices in the marketplace already mirror all identified info, and likewise change quick to replicate new data. Asset prices fully mirror the entire public and inside data obtainable.

Financial Management

It includes only risk-free transactions and the data used for trading is obtained without charge. Therefore, the revenue opportunities aren’t fully exploited, and it may be stated that arbitrage is a result of market inefficiency. As regards monetary policy, it affects funding demand through its effect on actual rate of interest.